- Industry leaders highlight potential shifts in Bitcoin’s traditional market cycle.

- Experts suggest institutional factors may end the cycle.

- Financial markets are adapting to reduced supply influences.

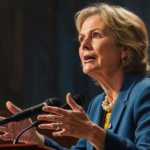

In 2025, industry leaders assert the traditional four-year Bitcoin cycle is obsolete, citing increased institutional adoption in the crypto market. Charles Edwards, among others, highlights structural changes after Bitcoin’s April 2024 halving.

The shift may redefine market dynamics, disrupting historical patterns. Institutional flows via ETFs mitigate volatility, while diminishing miner supply shocks warrant reassessment of Bitcoin market expectations.

The traditional four-year Bitcoin cycle is under scrutiny, with experts suggesting its predictability might be ending. Institutional adoption and macroeconomic factors have been cited as primary reasons for the potential change in this cyclical pattern.

Charles Edwards, founder of Capriole Investments, emphasized the changes, stating that Bitcoin’s supply dynamics now resemble a past era’s relics. “The dramatic, miner-driven busts of prior cycles look increasingly like artifacts of an earlier era. In short – the primary driving force behind Bitcoin cycle 80-90% drawdowns historically is dead.” The cycle’s predictability is now questioned by notable figures in the crypto industry, altering traditional views.

Institutional capital flows and ETFs are reshaping the market, as seen in the Bitcoin treasury accumulation by top firms. These factors reduce volatility and fundamentally alter the market’s cyclical nature, according to analysts and insiders.

On-chain data also supports these views, showing diminished traditional supply shocks. This leaves institutional and corporate entities as prominent influences on market behavior, overshadowing individual investors’ impacts.

While debates continue, market adaptations reflect reduced reliance on classic cycles. Speculative behavior has shifted towards more risk-tolerant assets, like memecoins, indicating diverging trends within the cryptocurrency space.

Prospective outcomes suggest a possible realignment of Bitcoin’s market behavior, with historical patterns giving way to institutional control. Experts believe this could herald a new phase with different regulatory, political, and economic implications.