- China plans yuan-backed stablecoin in response to USD stablecoin expansion.

- Potential reduction in renminbi’s global influence.

- Impacts on China’s financial sovereignty are emerging.

Chinese State Council reviews a yuan-backed stablecoin strategy to counter USD stablecoin influence amid increasing concern over financial sovereignty.

This policy shift could impact China’s global economic role and provoke market volatility in cross-border transactions.

China is reviewing the launch of a yuan-backed stablecoin as US dollar stablecoins rise. The Chinese State Council’s focus is on financial sovereignty and maintaining the renminbi’s relevance in international trade.

The Chinese State Council and JD Group Research Team are leading this effort. Concerns over the US dollar’s dominance have prompted strategic changes in China’s financial policies. A yuan-backed stablecoin is proposed to counter these issues. As an unnamed researcher from the JD Group Research Team notes, “U.S. government support for bank-issued stablecoins could spur a rapid increase in their usage, strengthening the dollar’s dominant position in global trade.”

The potential introduction of a yuan-backed stablecoin may impact China’s export sector, which could see increased use of dollar stablecoins. Financial stability and renminbi’s role in transactions are central to this discussion.

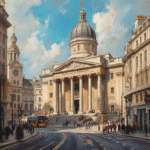

China’s plan includes a focus on cross-border payments, leveraging hubs in Hong Kong and Shanghai. Strengthening the renminbi’s internationalization is a primary goal amidst rising US stablecoin adoption.

The effects on the global cryptocurrency market remain uncertain. Current on-chain metrics lack specific data on future yuan-backed stablecoins, with policymakers still reviewing proposals.

China’s move reflects concerns over US government-backed stablecoin growth, as cited by JD Group Research. Financial analyses forecast up to $1.75 trillion new dollar-backed stablecoins impacting US and Chinese markets significantly.