- Senator Lummis confirms BITCOIN Act as U.S. playbook.

- Focus on budget-neutral strategic Bitcoin reserve.

- Fiscal discipline amid national debt concerns.

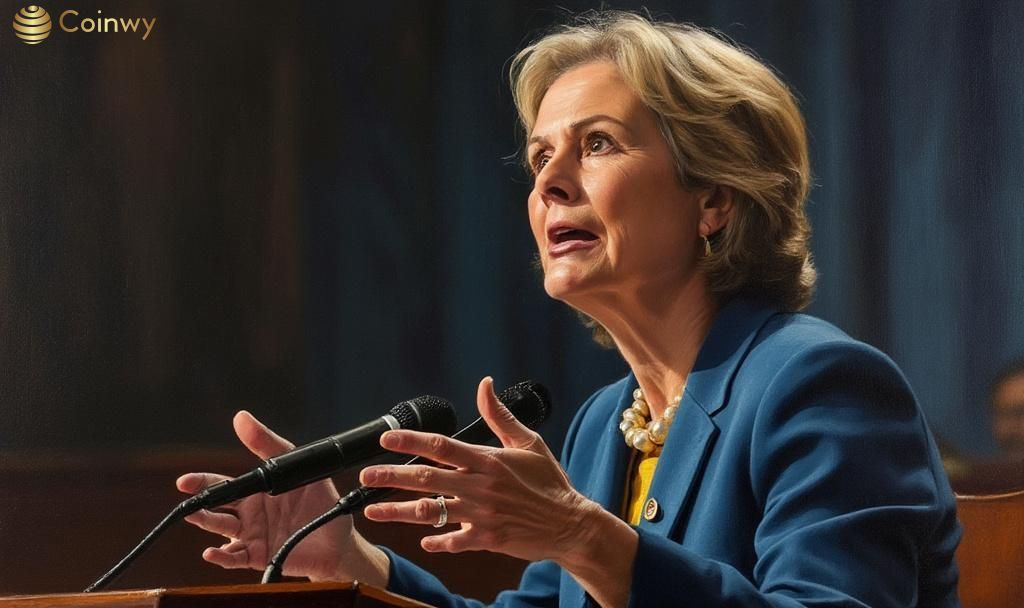

Senator Cynthia Lummis reaffirmed the BITCOIN Act as America’s digital asset strategy, emphasizing a budget-neutral bitcoin reserve, amid discussions of national debt and fiscal policies.

The BITCOIN Act’s focus on bitcoin reserves highlights changing U.S. fiscal strategies, with potential market impacts as the government plans large-scale BTC acquisitions amid financial policy debates.

Senator Cynthia Lummis has clarified the standing of the BITCOIN Act as the core strategy for U.S. digital asset policy. Amid growing debates on national debt, a budget-neutral approach is emphasized for the creation of a Strategic Bitcoin Reserve.

Lummis, a prominent Bitcoin advocate, leads this legislative effort, with participation from Secretary Scott Bessent and Cantor Fitzgerald CEO Howard Lutnick. The Act proposes using forfeited bitcoin without additional taxpayer funding, ensuring fiscal discipline.

The BITCOIN Act aims to impact mainly the Bitcoin market by authorizing up to 200,000 BTC purchases annually. Utilizing forfeited assets and gold revaluation suggests a strategic shift in government approach towards digital assets.

Building the Strategic Bitcoin Reserve without new federal funding emphasizes financial responsibility. This method allows the U.S. to manage debt obligations more efficiently, avoiding new expenditures while leveraging existing resources.

Cynthia Lummis, U.S. Senator, stated, “America needs the BITCOIN Act. [Secretary Scott Bessent is right: a budget-neutral path to building SBR is the way. We cannot save our country from $37T debt by purchasing more bitcoin, but we can revalue gold reserves to today’s prices & transfer the increase in value to build SBR. America needs the BITCOIN Act.”](https://twitter.com/abc/status/1)

The BITCOIN Act represents a significant policy change for handling digital assets, focusing exclusively on Bitcoin. By not involving other cryptocurrencies or assets, the government underscores Bitcoin’s unique position in its strategic reserve plans.

Historical precedents, such as President Trump’s 2025 executive order, align with current policies promoting accumulation over liquidation. These actions highlight a shift in federal asset management, potentially affecting Bitcoin’s market dynamics by government involvement.