Key Takeaways:

- Remittix presale fundraising figures remain unverifiable on-chain

- No public wallets provided to confirm capital inflows or allocation

- Community questions discrepancy between claimed raise and observable activity

- Analysts flag opacity in fund custody as a major investor risk signal

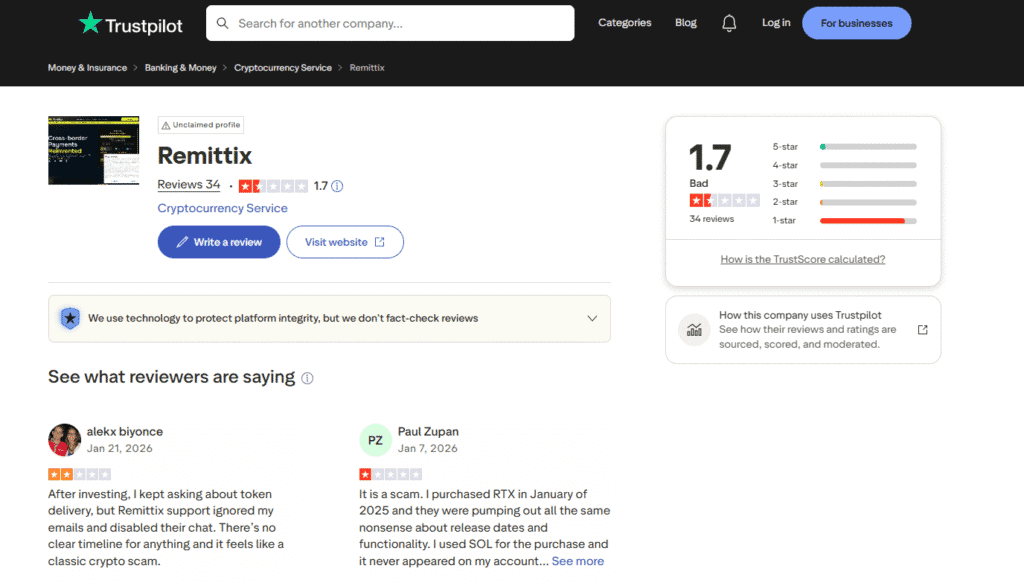

Remittix (RTX), a crypto-payment project marketing itself as a PayFi and remittance solution, is facing increased scrutiny as investors and analysts question the absence of verifiable on-chain evidence supporting its presale fundraising claims.

Despite public statements suggesting substantial capital participation, no official treasury wallets, escrow addresses, or allocation breakdowns have been disclosed to allow independent verification.

Blockchain observers note that legitimate presale projects typically provide at least one of the following:

- a public presale wallet

- a multisig treasury address

- on-chain dashboards tracking inflows

- transparent fund-allocation disclosures

In the case of Remittix, none of these mechanisms have been publicly confirmed, making it difficult to reconcile fundraising claims with observable blockchain data.

Community members have further raised concerns regarding fund custody and movement, questioning where presale proceeds are stored, who controls access, and whether any safeguards such as multisignature authorization or vesting constraints are in place. The lack of clarity has amplified speculation about capital handling practices behind the project.

Analysts emphasize that opacity around presale funds represents one of the highest-risk factors in early-stage crypto investments. Without on-chain traceability, investors have limited ability to assess whether capital is being used for development, liquidity provisioning, or operational expenses.

This risk is compounded when combined with anonymous leadership and limited technical disclosures, both of which remain unresolved issues for Remittix.

The situation underscores a broader industry concern: while blockchain systems are inherently transparent, projects can still operate off-chain narratives that are difficult for retail participants to independently verify.

Until Remittix provides public treasury visibility, auditable fund flows, and clear custody structures, analysts warn that presale participants may face elevated exposure to misallocation or loss of funds.

Read also :

- Remittix (RTX) Activates Live Settlement Execution Layer for Cross-Border Payments

- Remittix (RTX) Moves Into Live Settlement Execution as Multi-Route Transfer Framework Expands

- Remittix Enters Global Payment Infrastructure Debate as Focus Shifts Beyond Stablecoin Issuers

- Republic Europe Launches SPV for Kraken Stake

- VanEck Launches Avalanche ETF on Nasdaq