- NBA legend settles with FTX investors over crypto endorsements.

- Case terms remain confidential pending court approval.

- Crypto market unaffected by the settlement’s outcome.

Shaquille O’Neal has settled a class-action lawsuit with FTX investors over his crypto endorsements, closing a high-profile case with confidential terms.

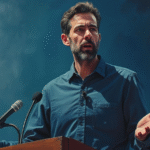

Shaquille O’Neal FTX lawsuit settlement

Shaquille O’Neal has reached a settlement with FTX investors in a lawsuit filed in Florida on April 23, 2025.

The settlement of Shaquille O’Neal’s lawsuit carries important legal ramifications, closing a chapter in FTX’s celebrity endorsements. This resolution does not appear to have significant immediate market impact.

In a case that highlights the scrutiny on celebrity involvement within the crypto market, Shaquille O’Neal settled a lawsuit for endorsing FTX. The case, filed by FTX investors, alleged promotions of unregistered securities. Despite endorsing the exchange, O’Neal claimed a lack of crypto understanding. The case was one among broader actions against celebrities associated with FTX, aiming for accountability through legal means.

“I was all in on FTX,” although he later claimed he did not truly understand crypto – Quoted in Class Action Discussion

The confidential settlement does not specify compensation but adds to industry reflections on endorsements. It falls under a broader class action seeking up to $21 billion in damages from various endorsers. Despite high-profile names involved, the settlement’s value seems similar to past cases involving relatively minor penalties.

The settlement lacks direct market impact based on available financial data. Current BTC and ETH prices show no reaction, aligning with a trend where legal outcomes without asset liquidation rarely influence prices. These lawsuits, involving others like Steph Curry and Tom Brady, highlight regulatory oversight in endorsements. Regulators continue evaluating PR practices in crypto promotions to ensure compliance.

Looking forward, celebrity endorsements could face more regulatory scrutiny, demanding transparency and responsibility. Past trends show few market disruptions unless linked to asset distributions. Continuous monitoring of crypto legal challenges and their impact on investor trust is evident.