- Anonymous whale buys $792M in Bitcoin after $1.05B liquidation.

- Institutional inflows provide price stabilization amid market volatility.

- No confirmed identity or statements about the whale purchase.

An unidentified investor recently acquired $792 million in Bitcoin following a significant liquidation event, where over $1.05 billion in leveraged positions were wiped out due to unexpected US inflation data.

This acquisition signals potential long-term stability in Bitcoin, attracting institutional interest like BlackRock, shaping short-term market sentiment, and potentially creating a new price support level.

An anonymous entity acquired $792 million in Bitcoin following a $1.05 billion liquidation event. Hotter-than-expected US inflation data triggered this liquidation, influencing both market dynamics and short-term sentiment among investors and institutions.

The identity of the anonymous whale remains undisclosed, while coinciding institutional activities from BlackRock signified significant market events. BlackRock acquired $523M in Bitcoin, creating a notable financial shift in the market framework.

The allocation of $792M in Bitcoin was among the largest post-liquidation purchases, marking a key moment for market stabilization. Institutional inflows, especially into Bitcoin and Ethereum, set a temporary price floor during volatility. Financial events such as leveraged position losses significantly impacted Bybit during this time. The losses in BTC and ETH indicate a notable trend in on-chain data, leading to stabilization reinforced by whale and institutional purchases.

Previous events suggest that whale or institutional purchases post-liquidation have historically provided market support. As retail confidence lags, significant institutional activity often leads to consolidation and eventual market recovery. Long-term analysis points to a steady holding pattern among investors, implying bullish sentiment.

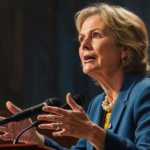

“The US will not be buying any Bitcoin for its Strategic Reserve,” but later added a willingness to explore “budget-neutral pathways” for reserve expansion. — Scott Bessent, Treasury Secretary

Treasury Secretary Scott Bessent clarified the US government’s stance on Bitcoin reserves, emphasizing exploration of different financial strategies.