Key Points

- Multiple independent risk-monitoring platforms have assigned elevated risk ratings to Remittix (RTX), a crypto project marketing cross-border payment and remittance services.

- The assessments reference limited ownership transparency, uncorroborated audit disclosures, and unfavorable user feedback.

- Market observers recommend increased due diligence as disclosure gaps remain unresolved.

Remittix (RTX) has recently drawn attention from third-party website trust and scam-detection services, several of which have categorized the project as high risk. The project, positioned as a crypto-to-fiat remittance solution, is now appearing on monitoring dashboards that evaluate factors such as transparency, technical verification, and community sentiment.

According to these evaluators, one recurring issue is the use of privacy-shielded domain registration, which prevents public identification of the entity behind the project. While not uncommon in the broader web ecosystem, analysts note that anonymous ownership structures tend to attract greater scrutiny when associated with token presales or fundraising campaigns.

In addition, review platforms have highlighted unclear audit references within Remittix’s promotional materials. Although audits are mentioned, independent reviewers report that verifiable audit reports and full technical documentation have not been consistently accessible, raising questions about the project’s development and security assurances.

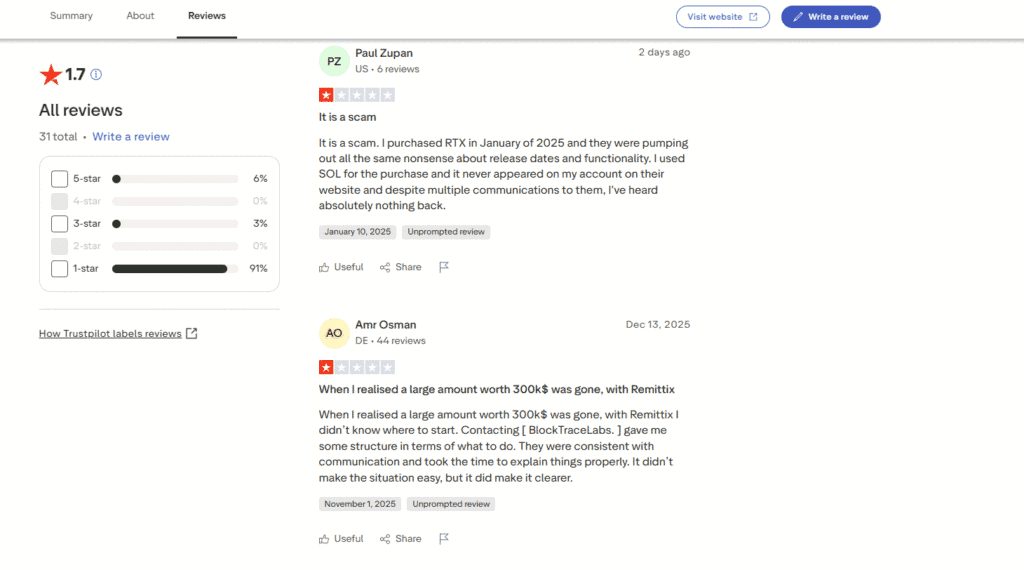

Feedback from consumer review sites, including Trustpilot, further contributes to the cautious outlook. A significant portion of user submissions describe negative experiences, such as delays in token distribution, difficulties accessing services, or unresolved presale-related issues. While some users report neutral outcomes, overall sentiment trends lean unfavorable.

Analysts suggest that the growing number of cautionary ratings reflects a broader shift in how participants assess early-stage crypto projects. Transparency, documented audits, and regulatory positioning are increasingly viewed as baseline requirements rather than optional features, particularly as regulatory oversight across digital asset markets continues to expand.

Until clearer disclosures or independently verified updates are released, Remittix is expected to remain under cautionary classification by monitoring services. At the time of publication, no confirmed public response addressing these specific concerns has been recorded.